Work with Money applications help members pave how to a substantial monetary future

Most of these impacted consumers had been eligible for simple, prime-rate mortgages, however, due to decreased client studies and you will financial supervision, the industry is actually rife that have abuse.

Ny 1199ers must have zero such as for instance concerns. The 1199SEIU Work for and you will Your retirement Money (NBF), due to their Real estate loan and Monetary Wellness Software, has actually helped many members create voice financial futures, resolve the borrowing and purchase the new land. During the 2015 by yourself, near to step one,200 users went to meetings, classes and you may individual counseling coaching supplied by new complimentary applications.

While i arrived in Nyc off Nigeria in 1997, one of my wants was to at some point very own my own personal domestic, states Eghosa Ijiogbe, a great CNA on Brooklyn Joined Methodist nursing domestic. My personal Commitment found my save your self making my fantasy become real.

Ijiogbe, just who lifestyle by yourself, considered an apartment and you may good coop however, felt like she need their own own property and you may yard. During the bria Levels, Queens.

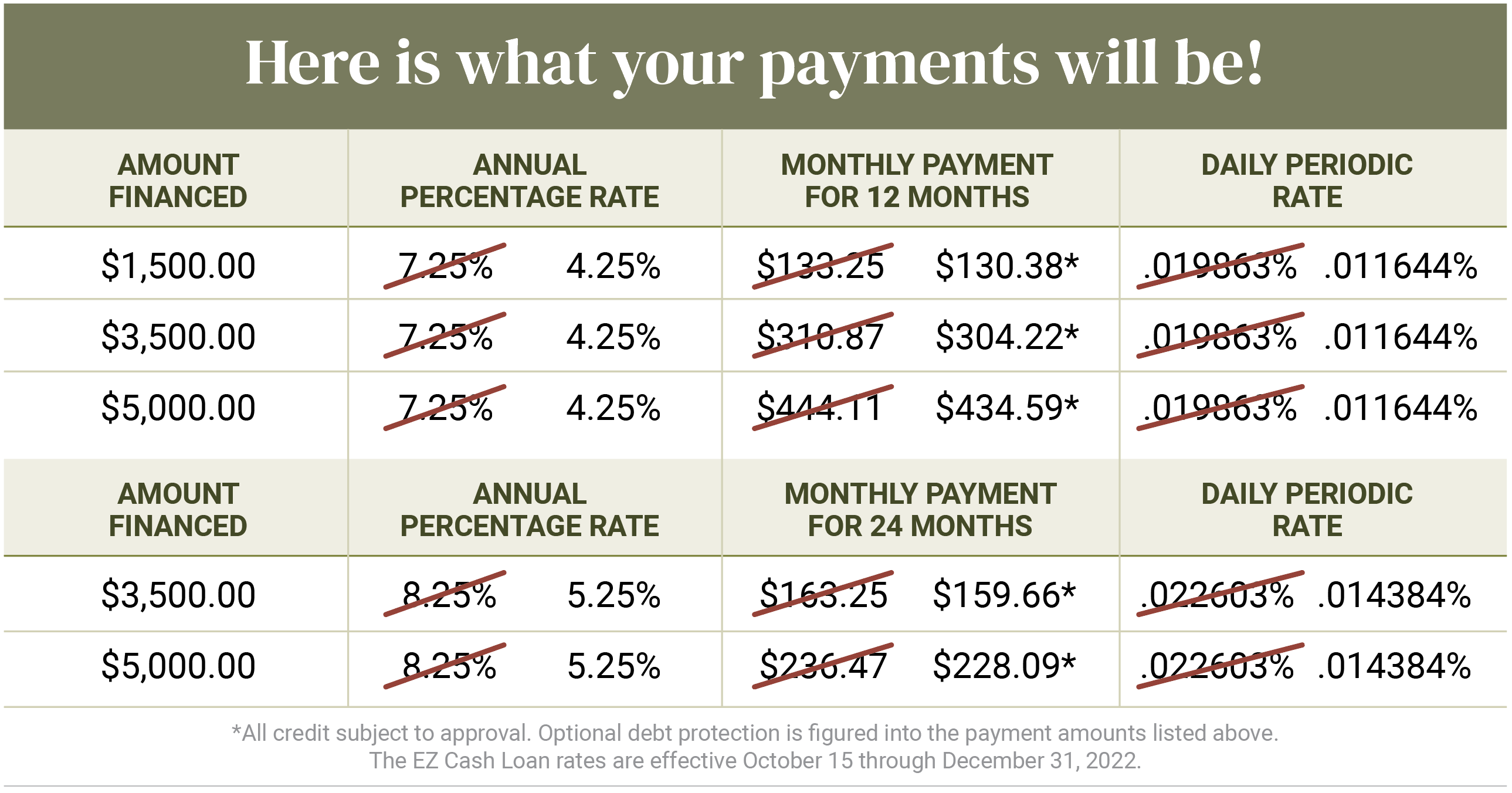

From System I found out that i could take away a reduced-attention mortgage up against my personal your retirement to help with my downpayment otherwise closing costs, she notes.

The commercial crisis out-of 2007- 2008 are precipitated mainly by a failure of your own sandwich-perfect mortgage loan markets; these types of funds have been peddled disproportionately so you’re able to low income home buyers just who was indeed given negative terminology-have a tendency to of the dishonest loan providers

I began the home-buying techniques of the probably a workshop at Union last year, states Anthony Cardona, a housekeeper within Bronx Lebanon Healthcare. The guy with his spouse, Karen Cardona, a Bronx Lebanon phlebotomist, closed on their Middletown, Ny, family when you look at the July. (more…)