Analogy step one: 10-year fixed home guarantee mortgage in the 8.75%

That have home loan costs hanging to eight.5% and you will home prices continuous i need a payday loan with bad credit in order to climb up in most avenues, of several potential housebuyers was choosing to go to on to order a property. However, while some buyers have forced stop, of several current property owners are capitalizing on exactly what today’s housing industry also offers all of them: highest degrees of household security .

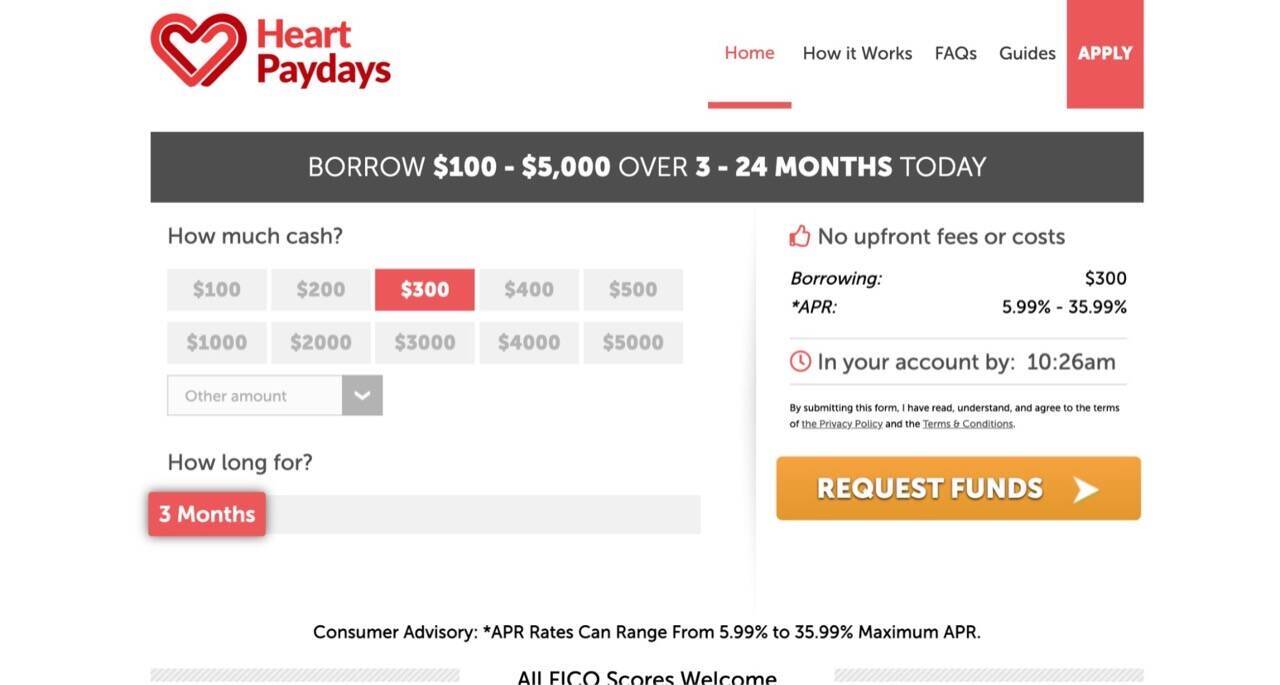

The average citizen already keeps from the $two hundred,000 property value tappable domestic collateral , that is borrowed against and also make home solutions, over home improvements if you don’t pay-off higher attract financial obligation. And you can, if you’re you will find several additional household collateral mortgage choices to select, nearly all of them currently give rates of interest which can be lower than just you’ll rating with credit cards otherwise personal bank loan, causing them to a sensible credit option.

But once you’re interested in a property collateral financing, it’s vital to see the monthly costs associated with individuals options. That way, you might determine whether a house guarantee mortgage suits to your finances as well as your economic bundle, one another now as well as the future.

Property guarantee mortgage , often referred to as the second financial, enables homeowners to borrow against the residence’s security. The interest prices, loan terms and you will percentage structures can vary certainly one of more loan choice, and they issues is significantly impression month-to-month costs.

You have many different identity solutions when it comes so you’re able to house collateral fund, however, a couple of usual are 10- and you will 15-year loan words. (more…)