Navigating the applying Techniques having a zero Earnings Confirmation Home Collateral Loan

A decreased debt-to-income (DTI) ratio is a must. Lenders choose good DTI away from 43 percent otherwise lower. Which steps your month-to-month expense against their monthly revenues, showing just how much capacity might has actually with additional debt.

Property Style of

Your property particular may affect your eligibility to own a no-money confirmation family guarantee mortgage. Single-family unit members property include the simplest, and you may apartments otherwise financial support attributes have more complicated conditions.

Dollars Reserves

Monetary supplies can also be strengthen your app. Lenders may prefer to look for particular deals or any other property from inside the addition to that particular, appearing as possible safety possible loan costs.

If the these standards is actually fulfilled, you are thought getting a zero-income confirmation home equity financing through RenoFi. This will improve process simple and problem-100 % free.

Taking a secure zero-income confirmation household guarantee mortgage will be easier for home owners just who must tap into the house’s equity without having any dilemma out-of delivering conventional earnings documentation. Here is a simple, step-by-action self-help guide to aid you through the application process.

1: Lookup Loan providers

Start with checking loan providers whom promote zero-money verification house collateral financing. Find an established business which have glamorous words and you will rates. It can be good for view on the web evaluations and you will pointers off family otherwise family relations for dependable lenders.

2: Collect Documents

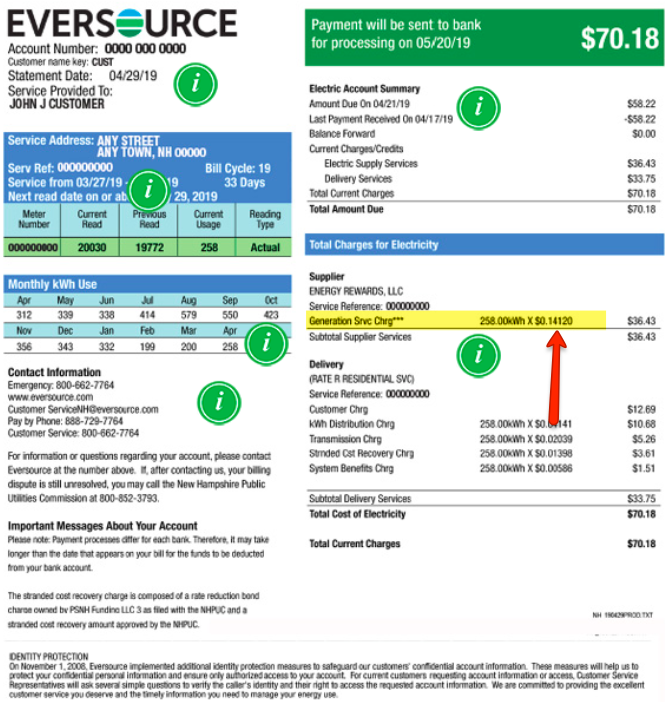

You would not be asked to promote all of the usual help records one mirror your earnings, for example pay stubs otherwise taxation statements. Certain loan providers, but not, can get ask you to provide proof homeownership thanks to home financing statement otherwise possessions tax bill and you may identity documentation such as for instance an effective driver’s licenses otherwise passport. (more…)