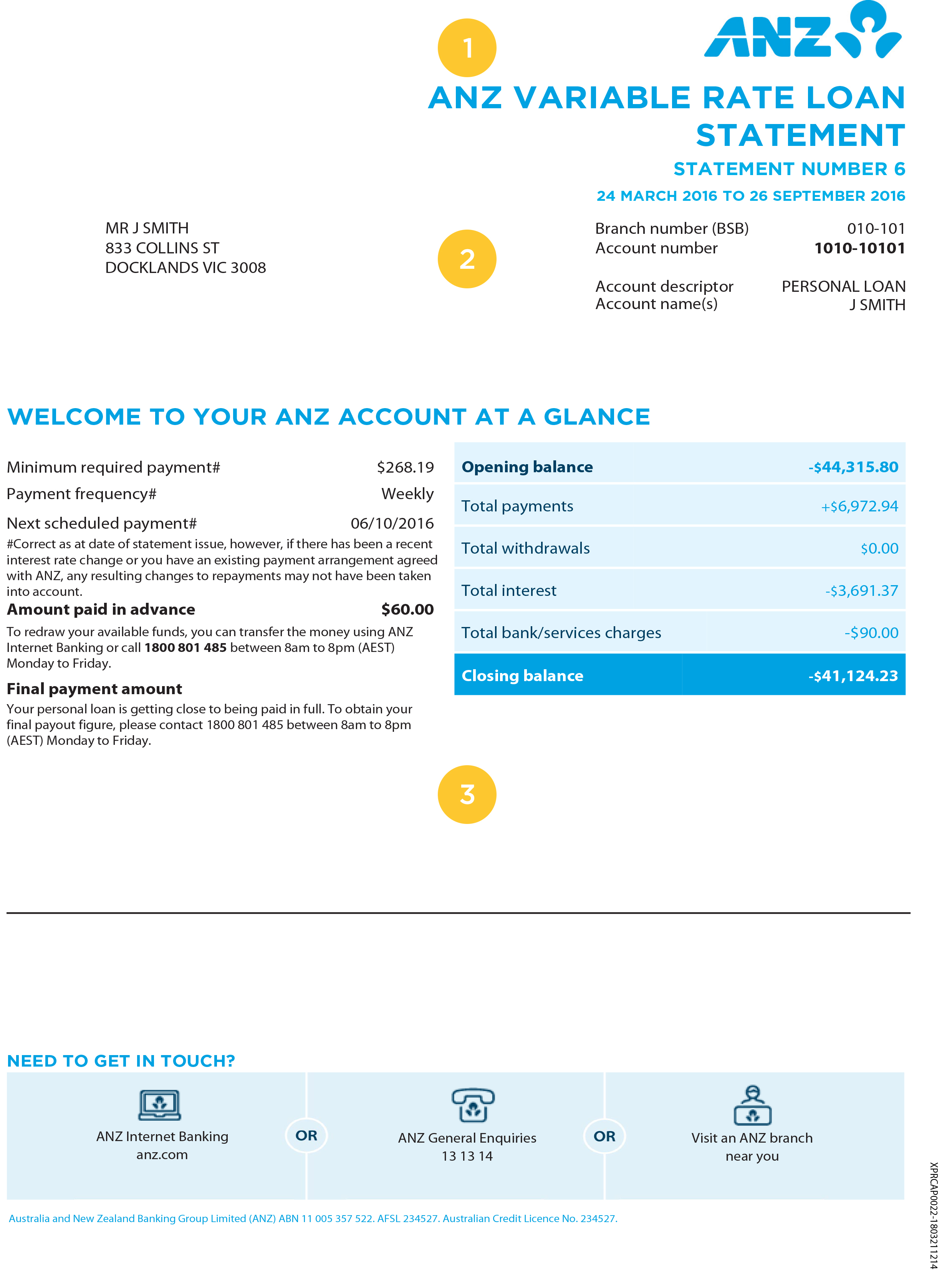

The latest maximum comes with every a great expenses you’ve got, such as car and truck loans, signature loans and charge card balances

Having rising cost of living controling headlines in the current months, rates of interest are prepared to go up subsequent regarding the future weeks. If you have come gonna and get a second possessions, this could be a lot of fun to begin with looking as the an effective escalation in rate of interest could mean stabilisation away from assets rates.

Except that the cost of the home, there are several things you’d need to be conscious of when to buy a second domestic, such qualifications, affordability and you can intent.

Qualification

For people who individual a personal assets, you will then be free to get a second personal possessions with no legal ramifications. Although not, in the event your basic home is a general public casing, whether it is a setup-to-Buy (BTO) flat, selling HDB flat, executive condominium (EC), or Design, Make and sell Design (DBSS) apartments, then you will need fulfil specific standards ahead of your purchase.

HDB flats incorporate a great 5-12 months Lowest Occupation Period (MOP) criteria, for example you’d have to inhabit one to property to have an effective at least 5 years one which just promote otherwise book your own apartment. You’ll also need to complete the latest MOP before the purchase of an exclusive assets.

Manage note that merely Singapore people should be able to individual both a keen HDB and you may a private property meanwhile. (more…)