Things to know about to purchase a home in the Nj-new jersey

Purchasing your earliest home in Nj-new jersey are going to be hard owed to your state’s relatively highest a property can cost you. But there is however a good amount of guidance available.

While you are an alternative Jersey earliest-time family client, the backyard Condition also offers a multitude of novel mortgage loans, down payment services, and academic programs. Here’s how to begin with.

Not surprisingly, to shop for regarding Garden County will be more expensive than other locations all over the country. Many people like Nj-new jersey once the most readily useful location to get its basic family for its miles from shoreline, historical towns and cities, and bad credit installment loans New Jersey you may personal distance so you’re able to Ny.

This new average sales speed getting land into the Nj-new jersey try $539,three hundred when you look at the , predicated on Redfin. That enhanced 8% in the prior seasons. As a result, first-date consumers regarding county s revealed less than.

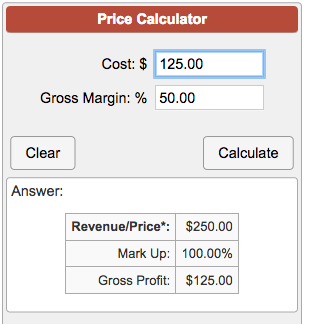

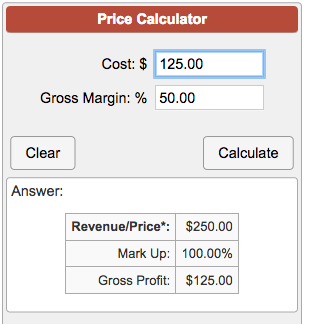

Down payment number are based on the newest country’s lately offered average house selling price. Minimum advance payment assumes on step 3% down on a traditional mortgage which have the absolute minimum credit history from 620.

If you are entitled to an effective Virtual assistant mortgage (supported by the fresh new Institution regarding Pros Affairs) or a USDA financing (supported by this new U.S. Department out-of Agriculture), you will possibly not you would like any down payment anyway.

First-go out homebuyer mortgage loans in the New jersey

If you have an excellent 20% advance payment and tend to be a first-big date house client within the Nj-new jersey, you can aquire a normal financing having a competitive interest and no individual mortgage insurance (PMI). (more…)